NOTE: Bloomberg Second Measure launched a new and exclusive transaction dataset in July 2022. Our data continues to be broadly representative of U.S. consumers. As a result of this panel change, however, we recommend using only the latest posts in assessing metrics, and do not support referring to historical blog posts to infer period-over-period comparisons.

Instant delivery companies proliferated early in the pandemic, especially in urban markets like New York City and Boston. But for many of these companies, their life cycle has also been ultrafast. In recent months, instant delivery competitors including Jokr, Buyk, and Fridge No More have permanently shut down or ceased operations in the U.S. However, one of the more established rapid delivery companies, Gopuff, is continuing to expand into new domestic and international markets. Consumer spending data shows that Gopuff—which is reportedly preparing for an IPO in the second half of 2022—has experienced strong U.S. sales growth over the past three years, corresponding with an expanding customer base as well as increased spending per customer.

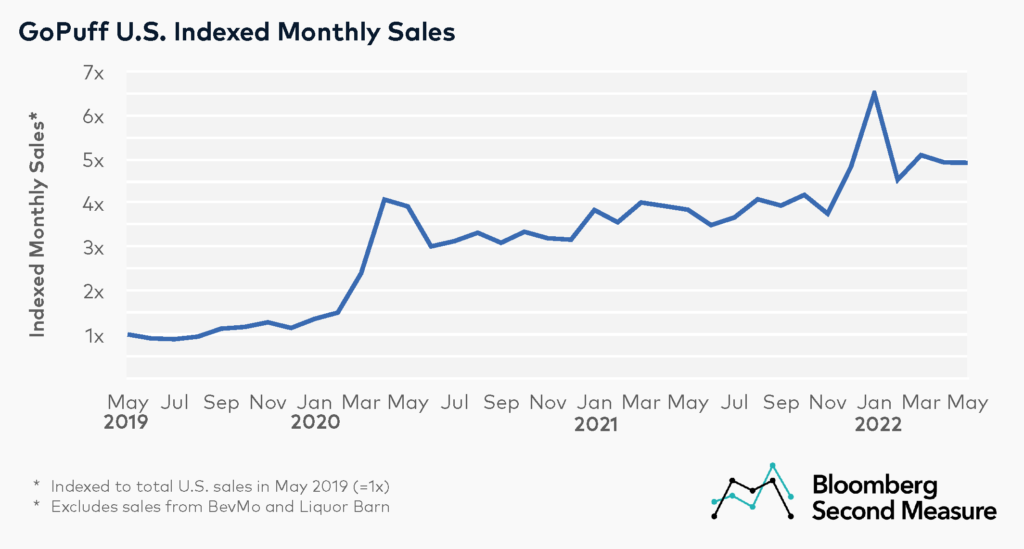

Gopuff’s sales nearly quintupled in three years

Gopuff was founded by two college students in Philadelphia in 2013, making it a pioneer in the instant delivery industry. The company delivers snacks, drinks, alcohol, essential goods—and, in some markets, fresh food—with a 30-minute guarantee. Our consumer spending data reveals that Gopuff’s U.S. sales skyrocketed over the past three years. In May 2022, Gopuff’s sales were 391 percent higher than in May 2019. Sales also grew 28 percent year-over-year.

Gopuff experienced a notable sales boost in the early months of the pandemic, with sales increasing 172 percent between February and April of 2020. The company also had a major spike in sales in January 2022, growing 35 percent month-over-month. A potential reason for the January sales growth is that rapid delivery companies like Gopuff reportedly experienced heightened demand for COVID-19 rapid tests as the omicron wave surged. Gopuff also launched its own private label products that month.

Aside from growing its own sales over the past three years, Gopuff also acquired the alcohol retailer BevMo in November 2020 and Liquor Barn in June 2021. BevMo and Liquor Barn sales are not included in this analysis.

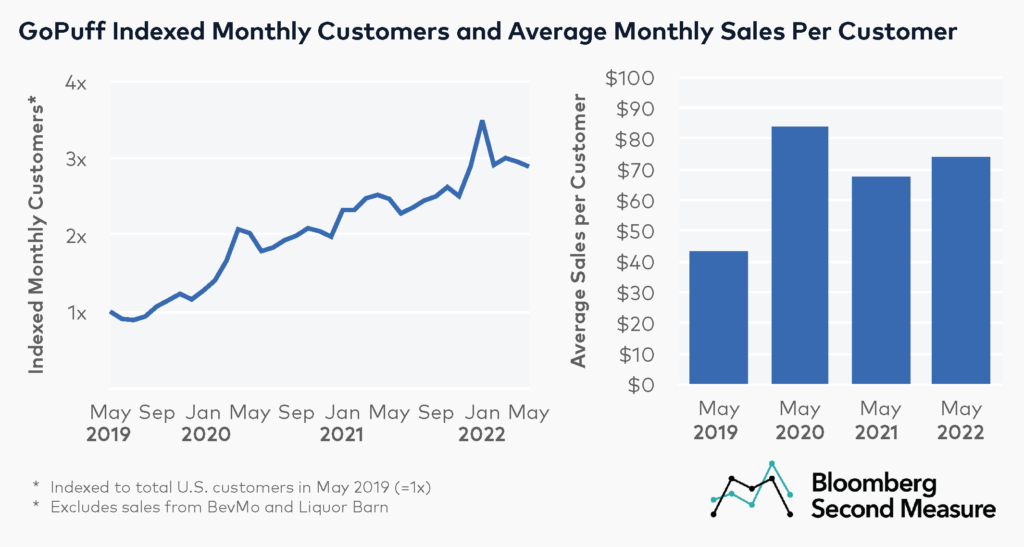

A growing customer base and elevated sales per customer have contributed to Gopuff’s sales growth

Mirroring Gopuff’s sales growth, the instant delivery service’s customer counts increased significantly over the past three years. In May 2022, Gopuff’s customer counts were 189 percent higher than in May 2019 and were 17 percent higher year-over-year.

A likely factor in Gopuff’s growing customer base is its expansion to new locations, with the company now reaching over 1,000 cities. In October 2021, Gopuff launched in New York City. Gopuff has also launched in international markets, including the U.K. and France. Notably, international spending is excluded from our analysis.

In addition to strong customer growth, consumer spending data shows that Gopuff’s average spending per customer has exceeded pre-pandemic levels. In May 2022, Gopuff’s average monthly sales per customer was $74, a 70 percent increase from the same month in 2019 and a 9 percent increase year-over-year. Gopuff’s average monthly sales per customer were higher early in the pandemic, with consumers spending an average of $84 with the company in May 2020.

Ahead of a potential Gopuff IPO, the company is still chasing profitability. Earlier this year, Gopuff increased its delivery fees and order minimum, in addition to closing some warehouses and cutting 3 percent of its global workforce. Last year, Gopuff was valued at $15 billion.

Meal delivery companies are also experimenting with rapid delivery

In recent months, Gopuff has been facing increased competition from more established delivery players. Food delivery companies like DoorDash have also expanded into ultrafast delivery for grocery and convenience store items. DoorDash also reportedly engaged in talks to buy Fridge No More, but the deal fell through, resulting in the rapid delivery startup’s closure. Similarly, Uber Eats entered partnerships with Gopuff and FastAF in order to enter the instant delivery market. The grocery delivery platform Instacart, which filed for an IPO in May 2022, also recently began piloting a 15-minute delivery program with retailers.

*Note: Bloomberg Second Measure regularly refreshes its panel and methods in order to provide the highest quality data that is broadly representative of U.S. consumers. As a result, we may restate historical data, including our blog content.